The Verify operation lets you post verification payments, which confirm the

validity of card information without reserving or charging any amount.

Introduction To Verify

This option is commonly used when initiating a subsequent One-click payment or an unscheduled purchase flow - where you do not want to charge the payer right away.

Please note that all boolean credit card attributes involving the rejection of certain card types are optional and require enabling on the contract with Swedbank Pay.

Verification Through Swedbank Pay Payments

- When properly set up in your merchant/webshop site, and the payer initiates

a verification operation, you make a

POSTrequest towards Swedbank Pay with your Verify information. This will create a payment resource with a uniqueid. You either receive a Redirect URL to a hosted page or a JavaScript source in response. - You need to

redirect the payer’s browser to that specified URL, or

embed the script source on your site to create a

Seamless View

in an

iframe; so that the payer can enter the card details in a secure Swedbank Pay hosted environment. - Swedbank Pay will handle 3-D Secure authentication when this is required.

- Swedbank Pay will redirect the payer’s browser to - or display directly in

the

iframe- one of two specified URLs, depending on whether the payment session is followed through completely or cancelled beforehand. Please note that both a successful and rejected payment reach completion, in contrast to a cancelled payment. - When you detect that the payer reach your completeUrl, you need to do a

GETrequest to receive the state of the transaction. - Finally you will make a

GETrequest towards Swedbank Pay with theidof the payment received in the first step, which will return the payment result and apaymentTokenthat can be used for subsequent One-Click Payments or aunscheduledTokenthat can be used for subsequent unscheduled server-to-server based payments.

API Requests

The API requests are displayed in the Verification flow below. The options you can choose from when creating a payment with key operation set to Value Verify are listed below.

Please note that not including paymentUrl in the request will generate a

redirect-verification operation in the response, meant to be used in the

Redirect flow. Adding paymentUrl input will generate the response meant for

Seamless View, which does not include the redirect-verification. The request

below is the Redirect option.

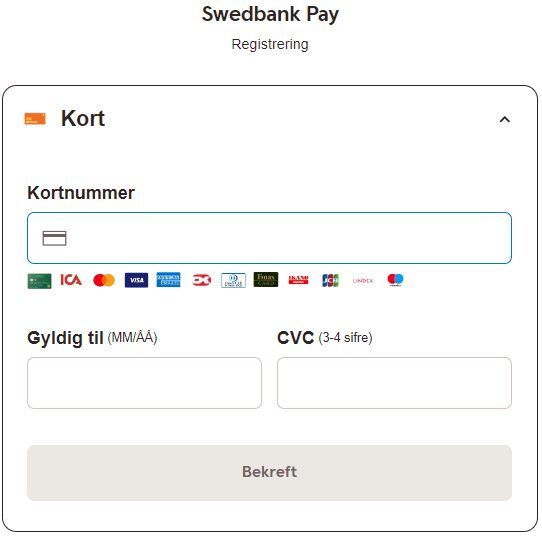

How It Looks

You will redirect the payer to Swedbank Pay hosted pages to collect the card information.

Verify Request

Request

1

2

3

4

POST /psp/creditcard/payments HTTP/1.1

Host: api.externalintegration.payex.com

Authorization: Bearer <AccessToken>

Content-Type: application/json

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

{

"payment": {

"operation": "Verify",

"currency": "NOK",

"description": "Test Verification",

"userAgent": "Mozilla/5.0...",

"language": "nb-NO",

"generatePaymentToken": true,

"urls": {

"hostUrls": ["https://example.com", "https://example.net"],

"completeUrl": "https://example.com/payment-completed",

"cancelUrl": "https://example.com/payment-cancelled",

"logoUrl": "https://example.com/payment-logo.png",

"termsOfServiceUrl": "https://example.com/payment-terms.html"

},

"payeeInfo": {

"payeeId": "5cabf558-5283-482f-b252-4d58e06f6f3b",

"payeeReference": "CD1234",

"payeeName": "Merchant1",

"productCategory": "A123",

"orderReference": "or-12456",

"subsite": "MySubsite",

},

"payer": {

"payerReference": "AB1234",

}

},

"creditCard": {

"rejectCreditCards": false,

"rejectDebitCards": false,

"rejectConsumerCards": false,

"rejectCorporateCards": false

}

}

Verify Response

Response

1

2

HTTP/1.1 200 OK

Content-Type: application/json

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

{

"payment": {

"id": "/psp/creditcard/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1",

"number": 1234567890,

"created": "2016-09-14T13:21:29.3182115Z",

"updated": "2016-09-14T13:21:57.6627579Z",

"operation": "Verify",

"state": "Ready",

"currency": "NOK",

"amount": 0,

"description": "Test Verification",

"initiatingSystemUserAgent": "swedbankpay-sdk-dotnet/3.0.1",

"userAgent": "Mozilla/5.0",

"language": "nb-NO",

"transactions": { "id": "/psp/creditcard/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/transactions" },

"verifications": { "id": "/psp/creditcard/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/verifications" },

"urls" : { "id": "/psp/creditcard/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/urls" },

"payeeInfo" : { "id": "/psp/creditcard/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/payeeInfo" },

"payers": { "id": "/psp/creditcard/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/payers" },

"settings": { "id": "/psp/creditcard/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/settings" }

},

"operations": [

{

"href": "https://api.externalintegration.payex.com/psp//payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1",

"rel": "update-payment-abort",

"method": "PATCH",

"contentType": "application/json"

},

{

"href": "https://ecom.externalintegration.payex.com/payments/verification/5a17c24e-d459-4567-bbad-aa0f17a76119",

"rel": "redirect-verification",

"method": "GET",

"contentType": "application/json"

},

{

"method": "GET",

"href": "https://ecom.externalintegration.payex.com/core/scripts/client/px.creditcard.client.js?token=5a17c24e-d459-4567-bbad-aa0f17a76119",

"rel": "view-verification",

"contentType": "application/javascript"

},

{

"method": "POST",

"href": "https://ecom.externalintegration.payex.com/psp//confined/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/verifications",

"rel": "direct-verification",

"contentType": "application/json"

}

]

}

Verification Flow

The sequence diagram below shows the two requests you have to send to Swedbank Pay to make a purchase. The links will take you directly to the API description for the specific request. The diagram also shows in high level, the sequence of the process of a complete purchase. When dealing with credit card payments, 3-D Secure authentication of the cardholder is an essential topic. There are three alternative outcome of a credit card payment:

- 3-D Secure enabled - by default, 3-D Secure should be enabled, and Swedbank Pay will check if the card is enrolled with 3-D Secure. This depends on the issuer of the card. If the card is not enrolled with 3-D Secure, no authentication of the cardholder is done.

- Card supports 3-D Secure - if the card is enrolled with 3-D Secure, Swedbank Pay will redirect the cardholder to the autentication mechanism that is decided by the issuing bank. Normally this will be done using BankID or Mobile BankID.

sequenceDiagram

participant Payer

participant Merchant

participant SwedbankPay as Swedbank Pay

participant IssuingBank

activate Payer

Payer->>+Merchant: start verification

deactivate Payer

Merchant->>+SwedbankPay: POST /psp//payments(operation=VERIFY)

deactivate Merchant

note left of Payer: First API request

SwedbankPay-->+Merchant: payment resource

deactivate SwedbankPay

Merchant-->>+Payer: redirect to verification page

deactivate Merchant

Payer->>+SwedbankPay: access verification page

deactivate Payer

note left of Payer: redirect to SwedbankPay<br>(If Redirect scenario)

SwedbankPay-->>+Payer: display purchase information

deactivate SwedbankPay

Payer->>Payer: input information

Payer->>+SwedbankPay: submit information

deactivate Payer

opt Card supports 3-D Secure

SwedbankPay-->>Payer: redirect to IssuingBank

deactivate SwedbankPay

Payer->>IssuingBank: 3-D Secure authentication process

Payer->>+SwedbankPay: access authentication page

deactivate Payer

end

SwedbankPay-->>+Payer: redirect to merchant

deactivate SwedbankPay

note left of Payer: redirect back to merchant<br>(If Redirect scenario)

Payer->>+Merchant: access merchant page

Merchant->>+SwedbankPay: GET <payment.id>

deactivate Merchant

note left of Merchant: Second API request

SwedbankPay-->>+Merchant: rel: redirect-authorization

deactivate SwedbankPay

Merchant-->>Payer: display purchase result

deactivate Merchant

opt Callback is set

activate SwedbankPay

SwedbankPay->>SwedbankPay: Payment is updated

SwedbankPay->>Merchant: POST Payment Callback

deactivate SwedbankPay

end