MobilePay Online redirect integration flow

- When you have prepared your merchant/webshop site, you make a

POSTrequest towards Swedbank Pay with your Purchase information. - You will receive a Redirect URL, leading to a secure Swedbank Pay hosted environment, in response.

- You need to redirect the browser of the payer to that URL so that they may enter their MobilePay details.

- When the payment is completed, Swedbank Pay will redirect the browser back to your merchant/webshop site.

- Finally you need to make a

GETrequest towards Swedbank Pay with thepaymentIDreceived in the first step, which will return the purchase result.

Defining

callbackUrl: When implementing a scenario, it is strongly recommended to set

a callbackUrl in the POST request. If callbackUrl is set, Swedbank Pay

will send a POST request to this URL when the payer has fulfilled the

payment.

Step 1: Create A Purchase

When the payer starts the purchase process, you make a POST request towards

Swedbank Pay with the collected Purchase information. This will generate a

payment with a unique id. See the POSTrequest example below.

GDPR: GDPR

sensitive data such as email, phone numbers and social security numbers must

not be used directly in request fields such as payerReference. If it is

necessary to use GDPR sensitive data, it must be hashed and then the hash can be

used in requests towards Swedbank Pay.

Redirect Request

Request

1

2

3

POST /psp/mobilepay/payments HTTP/1.1

Authorization: Bearer <AccessToken>

Content-Type: application/json

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

{

"payment": {

"operation": "Purchase",

"intent": "Authorization",

"currency": "DKK",

"prices": [

{

"type": "MobilePay",

"amount": 1500,

"vatAmount": 0

}

],

"description": "Test Purchase",

"userAgent": "Mozilla/5.0...",

"language": "da-DK",

"urls": {

"hostUrls": [ "https://example.com", "https://example.net" ],

"completeUrl": "https://example.com/payment-completed",

"cancelUrl": "https://example.com/payment-cancelled",

"callbackUrl": "https://example.com/payment-callback",

"termsOfServiceUrl": "https://example.com/payment-terms.pdf"

},

"payeeInfo": {

"payeeId": "5cabf558-5283-482f-b252-4d58e06f6f3b",

"payeeReference": "CD1234",

"payeeName": "Merchant1",

"productCategory": "A123",

"orderReference": "or-12456",

"subsite": "MySubsite"

},

"payer": {

"payerReference": "AB1234",

},

"prefillInfo": {

"msisdn": "+4598765432"

}

},

"mobilepay": {

"shoplogoUrl": "https://example.com/shop-logo.png"

}

}

| Required | Field | Data type | Description |

|---|---|---|---|

| check | payment |

object |

The payment object. |

| check | operation |

string |

Determines the initial operation, defining the type of payment created. Possible options are Purchase, Abort Verify, UnscheduledPurchase, Recur and Payout. |

| check | intent |

string |

Authorization |

| check | currency |

enum(string) |

The currency of the payment order in the ISO 4217 format (e.g. DKK, EUR, NOK or SEK). Some payment methods are only available with selected currencies. |

| check | prices |

object |

The prices object. |

| check | type |

string |

Use the value ``.See the prices resource for more information. |

| check | amount |

integer |

The transaction amount (including VAT, if any) entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 DKK, 5000 = 50.00 DKK. |

| check | vatAmount |

integer |

The payment’s VAT (Value Added Tax) amount, entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 DKK, 5000 = 50.00 DKK. The vatAmount entered will not affect the amount shown on the payment page, which only shows the total amount. This field is used to specify how much of the total amount the VAT will be. Set to 0 (zero) if there is no VAT amount charged. |

feeAmount |

integer |

If the amount given includes Fee, this may be displayed for the user in the payment page (redirect only). | |

| check | description |

string(40) |

A textual description of the purchase. Maximum length is 40 characters. |

| check | userAgent |

string |

The user agent of the payer. Should typically be set to the value of the User-Agent header sent by the payer’s web browser. |

| check | language |

enum(string) |

Allowed locale code values: da-DK, fi-FI or en-US. |

| check | urls |

object |

The URLs object containing the urls used for this payment. |

| check | completeUrl |

string |

The URL that Swedbank Pay will redirect back to when the payer has completed their interactions with the payment. This does not indicate a successful payment, only that it has reached a final (complete) state. A GET request needs to be performed on the payment to inspect it further. See completeUrl for details. |

| check | cancelUrl |

string |

The URL that Swedbank Pay will redirect back to when the user presses the cancel button in the payment page. |

callbackUrl |

string |

The URL that Swedbank Pay will perform an HTTP POST against every time a transaction is created on the payment. See callback for details. |

|

| check | termsOfServiceUrl |

string |

The URL to the terms of service document which the payer must accept in order to complete the payment. HTTPS is a requirement. |

| check | payeeInfo |

object |

This object contains the identificators of the payee of this payment. |

| check | payeeId |

string |

This is the unique id that identifies this payee (like merchant) set by Swedbank Pay. |

| check | payeeReference |

string(30) |

A unique reference from the merchant system. Set per operation to ensure an exactly-once delivery of a transactional operation. Length and content validation depends on whether the transaction.number or the payeeReference is sent to the acquirer. If Swedbank Pay handles the settlement, the transaction.number is sent to the acquirer and the payeeReference must be in the format of A-Za-z0-9 and string(30). If you handle the settlement, Swedbank Pay will send the payeeReference and it will be limited to the format of string(12). All characters must be digits. |

payeeName |

string |

The payee name (like merchant name) that will be displayed when redirected to Swedbank Pay. | |

productCategory |

string(50) |

A product category or number sent in from the payee/merchant. This is not validated by Swedbank Pay, but will be passed through the payment process and may be used in the settlement process. | |

orderReference |

string(50) |

The order reference should reflect the order reference found in the merchant’s systems. | |

subsite |

string(40) |

The subsite field can be used to perform a split settlement on the payment. The different subsite values must be resolved with Swedbank Pay reconciliation before being used. If you send in an unknown subsite value, it will be ignored and the payment will be settled using the merchant’s default settlement account. Must be in the format of A-Za-z0-9. |

|

payer |

string |

The payer object, containing information about the payer. |

|

payerReference |

string |

The reference to the payer from the merchant system, like e-mail address, mobile number, customer number etc. Mandatory if generateRecurrenceToken, RecurrenceToken, generatePaymentToken or paymentToken is true. |

|

prefillInfo |

object |

An object that holds prefill information that can be inserted on the payment page. | |

msisdn |

string |

Number will be prefilled on MobilePay’s page, if valid. Only Danish and Finnish phone numbers are supported. The country code prefix is +45 and +358 respectively. | |

mobilepay.shoplogoUrl |

string |

URI to the logo that will be visible at MobilePay Online. For it to be displayed correctly in the MobilePay app, the image must be 250x250 pixels, a png or jpg served over a secure connection using https, and be publicly available. This URI will override the value configured in the contract setup. |

Redirect Response

Response

1

2

HTTP/1.1 200 OK

Content-Type: application/json

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

{

"payment": {

"prices": {

"id": "/psp/mobilepay/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/prices"

},

"id": "/psp/mobilepay/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1",

"number": 75100000121,

"created": "2018-09-11T10:58:27.4236127Z",

"updated": "2018-09-11T10:58:30.8254419Z",

"instrument": "MobilePay",

"operation": "Purchase",

"intent": "Authorization",

"state": "Ready",

"currency": "DKK",

"amount": 0,

"description": "Test Purchase",

"initiatingSystemUserAgent": "swedbankpay-sdk-dotnet/3.0.1",

"userAgent": "Mozilla/5.0",

"language": "da-DK",

"transactions": {

"id": "/psp/mobilepay/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/transactions"

},

"urls": {

"id": "/psp/mobilepay/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/urls"

},

"payeeInfo": {

"id": "/psp/mobilepay/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/payeeinfo"

},

"payers": {

"id": "/psp/mobilepay/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/payers"

}

},

"operations": [

{

"method": "PATCH",

"href": "https://api.externalintegration.payex.com/psp/mobilepay/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1",

"rel": "update-payment-abort"

},

{

"method": "GET",

"href": "https://ecom.externalintegration.payex.com/mobilepay/payments/authorize/ec2a9b09-601a-42ae-8e33-a5737e1cf177",

"rel": "redirect-authorization"

}

]

}

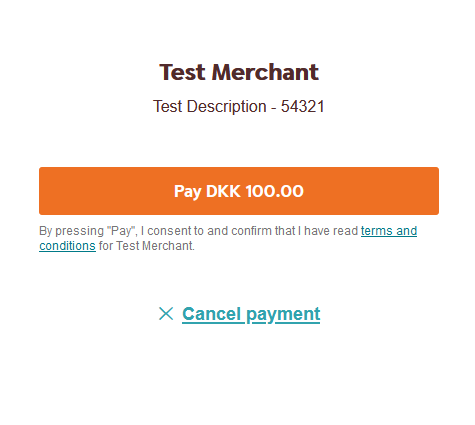

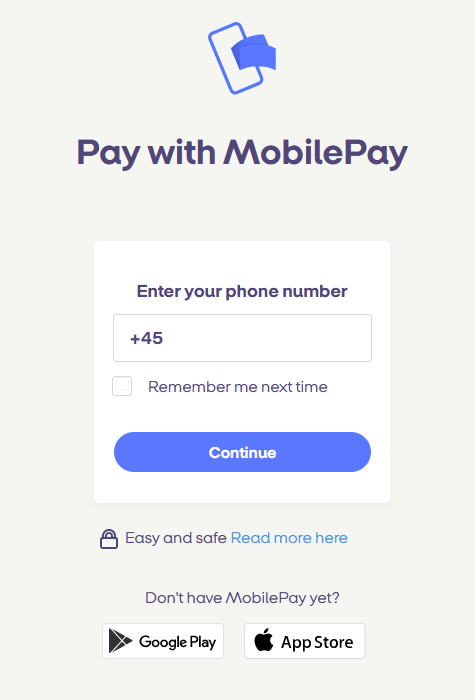

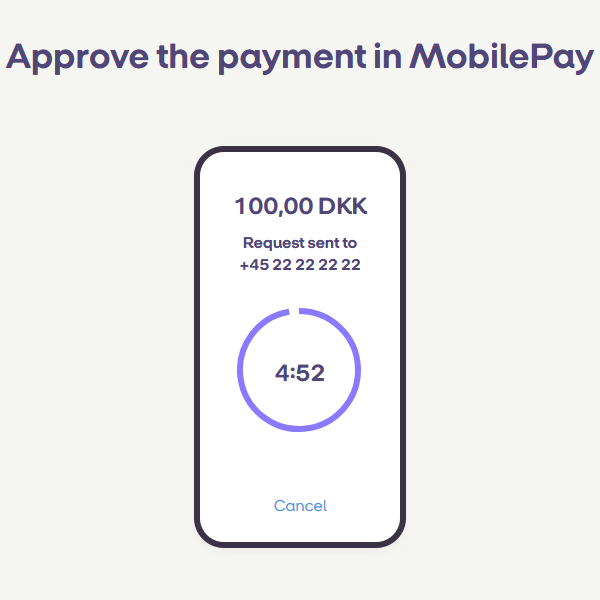

How It Looks

Step 2: Get The Transaction Status

Finally you need to make a GET request towards Swedbank Pay with the id of

the payment received in the first step, which will return the purchase result.

GET Transaction Status Request

Request

1

2

3

4

GET /psp/mobilepay/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/ HTTP/1.1

Host: api.externalintegration.payex.com

Authorization: Bearer <AccessToken>

Content-Type: application/json

GET Transaction Status Response

Response

1

2

HTTP/1.1 200 OK

Content-Type: application/json

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

{

"payment": {

"id": "/psp/mobilepay/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1",

"number": 1234567890,

"created": "2016-09-14T13:21:29.3182115Z",

"updated": "2016-09-14T13:21:57.6627579Z",

"state": "Ready",

"operation": "Purchase",

"intent": "Authorization",

"currency": "DKK",

"amount": 1500,

"remainingCaptureAmount": 1500,

"remainingCancellationAmount": 1500,

"remainingReversalAmount": 0,

"description": "Test Purchase",

"initiatingSystemUserAgent": "swedbankpay-sdk-dotnet/3.0.1",

"userAgent": "Mozilla/5.0...",

"language": "da-DK",

"prices": {

"id": "/psp/mobilepay/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/prices"

},

"payeeInfo": {

"id": "/psp/mobilepay/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/payeeInfo"

},

"payers": {

"id": "/psp/mobilepay/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/payers"

}

"urls": {

"id": "/psp/mobilepay/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/urls"

},

"transactions": {

"id": "/psp/mobilepay/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/transactions"

},

"authorizations": {

"id": "/psp/mobilepay/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/authorizations"

},

"captures": {

"id": "/psp/mobilepay/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/captures"

},

"reversals": {

"id": "/psp/mobilepay/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/reversals"

},

"cancellations": {

"id": "/psp/mobilepay/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/cancellations"

}

},

"operations": [

{

"method": "PATCH",

"href": "https://api.externalintegration.payex.com/psp/mobilepay/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1",

"rel": "update-payment-abort",

"contentType": "application/json"

},

{

"method": "GET",

"href": "https://ecom.externalintegration.payex.com/mobilepay/core/scripts/client/px.mobilepay.client.js?token=5a17c24e-d459-4567-bbad-aa0f17a76119&operation=authorize",

"rel": "view-authorization",

"contentType": "application/javascript"

},

{

"method": "GET",

"href": "https://ecom.externalintegration.payex.com/mobilepay/payments/authorize/ec2a9b09-601a-42ae-8e33-a5737e1cf177",

"rel": "redirect-authorization",

"contentType": "text/html"

},

{

"method": "POST",

"href": "https://api.externalintegration.payex.com/psp/mobilepay/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/captures",

"rel": "create-capture",

"contentType": "application/json"

},

{

"method": "GET",

"href": "https://api.externalintegration.payex.com/psp/mobilepay/7e6cdfc3-1276-44e9-9992-7cf4419750e1/paid",

"rel": "paid-payment",

"contentType": "application/json"

},

{

"method": "GET",

"href": "https://api.externalintegration.payex.com/psp/mobilepay/7e6cdfc3-1276-44e9-9992-7cf4419750e1/failed",

"rel": "failed-payment",

"contentType": "application/problem+json"

}

]

}

| Field | Type | Description |

|---|---|---|

payment |

object |

The payment object contains information about the specific payment. |

id |

string |

The relative URL and unique identifier of the payment resource . Please read about URL Usage to understand how this and other URLs should be used in your solution. |

number |

integer |

The payment number, useful when there’s need to reference the payment in human communication. Not usable for programmatic identification of the payment, where id should be used instead. |

created |

date(string) |

The ISO 8601 date and time when the payment was created. |

updated |

date(string) |

The ISO 8601 date and time when the payment was updated. |

state |

string |

Ready, Pending, Failed or Aborted. Indicates the state of the payment, not the state of any transactions performed on the payment. To find the state of the payment’s transactions (such as a successful authorization), see the transactions resource or the different specialized type-specific resources such as authorizations or sales. |

prices |

object |

The prices resource lists the prices related to a specific payment. |

prices.id |

string |

The relative URL and unique identifier of the prices resource . Please read about URL Usage to understand how this and other URLs should be used in your solution. |

description |

string(40) |

A textual description of the purchase. Maximum length is 40 characters. |

userAgent |

string |

The user agent of the payer. Should typically be set to the value of the User-Agent header sent by the payer’s web browser. |

language |

enum(string) |

Allowed locale code values: da-DK, fi-FI or en-US. |

urls |

string |

The URL to the urls resource where all URLs related to the payment can be retrieved. |

payeeInfo |

object |

The payeeInfo object, containing information about the payee (the recipient of the money). See payeeInfo for details. |

payers |

string |

The URL to the payer resource where the information about the payer can be retrieved. |

operations |

array |

The array of operations that are possible to perform on the payment in its current state. |

method |

string |

The HTTP method to use when performing the operation. |

href |

string |

The target URL to perform the operation against. |

rel |

string |

The name of the relation the operation has to the current resource. |

MobilePay Redirect Sequence Diagram

The sequence diagram below shows the two requests you have to send to Swedbank Pay to make a purchase. The diagram also shows at a high level, the sequence of the process of a complete purchase.

sequenceDiagram

participant Payer

participant Merchant

participant SwedbankPay as Swedbank Pay

participant MobilePay_API as MobilePay API

participant MobilePay_App as MobilePay App

Payer->>Merchant: start purchase (pay with MobilePay)

activate Merchant

Merchant->>SwedbankPay: POST <Create MobilePay Online payment>

note left of Merchant: First API request

activate SwedbankPay

SwedbankPay-->>Merchant: payment resource

deactivate SwedbankPay

SwedbankPay -->> SwedbankPay: Create payment

Merchant-->>Payer: Redirect to payment page

note left of Payer: redirect to MobilePay

Payer-->>SwedbankPay: enter mobile number

activate SwedbankPay

SwedbankPay-->>MobilePay_API: Initialize MobilePay Online payment

activate MobilePay_API

MobilePay_API-->>SwedbankPay: response

SwedbankPay-->>Payer: Authorization response (State=Pending)

note left of Payer: check your phone

deactivate Merchant

MobilePay_API-->>MobilePay_App: Confirm Payment UI

MobilePay_App-->>MobilePay_App: Confirmation Dialog

MobilePay_App-->>MobilePay_API: Confirmation

MobilePay_API-->>SwedbankPay: make payment

activate SwedbankPay

SwedbankPay-->>SwedbankPay: execute payment

SwedbankPay-->>MobilePay_API: response

deactivate SwedbankPay

deactivate MobilePay_API

SwedbankPay-->>SwedbankPay: authorize result

SwedbankPay-->>Payer: authorize result

Payer-->>Merchant: Redirect to merchant

note left of Payer: Redirect to merchant

activate Merchant

SwedbankPay-->>Merchant: Payment Callback

Merchant-->>SwedbankPay: GET <MobilePay payments>

note left of Merchant: Second API request

SwedbankPay-->>Merchant: Payment resource

deactivate SwedbankPay

Merchant-->>Payer: Display authorize result

deactivate Merchant