Introduction

Seamless View provides an integration of the payment process directly on your

website. This solution offers a smooth shopping experience with Swedbank Pay

payment pages seamlessly integrated in an iframe on your website. The payer

does not need to leave your webpage, since we are handling the payment in the

iframe on your page.

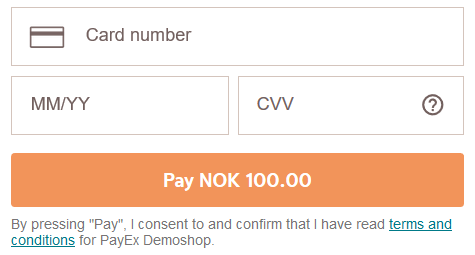

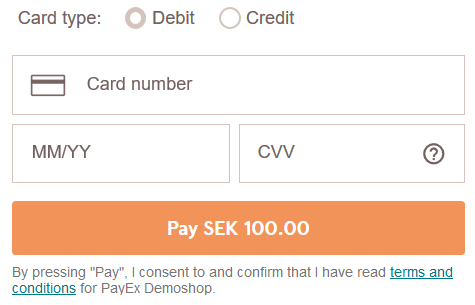

How It Looks

For payments in the currency SEK, radio buttons for selecting debit or credit card will appear.

Step 1: Create Payment

A Purchase payment is a straightforward way to charge the card of the payer.

It is followed up by posting a capture, cancellation or reversal transaction.

An example of an abbreviated POST request is provided below. Each individual

field of the JSON document is described in the following section. An example of

an expanded POST request is available in the

other features section.

To minimize the risk for

a challenge request (Strong Customer Authentication – “SCA”) on card payments,

it’s recommended that you add as much data as possible to the riskIndicator

object in the request below.

When properly set up in your merchant/webshop site and the payer starts the

purchase process, you need to make a POST request towards Swedbank Pay with your

Purchase information. This will generate a payment object with a unique

paymentID. You will receive a JavaScript source in response.

GDPR: GDPR

sensitive data such as email, phone numbers and social security numbers must

not be used directly in request fields such as payerReference. If it is

necessary to use GDPR sensitive data, it must be hashed and then the hash can be

used in requests towards Swedbank Pay.

Purchase

A Purchase payment is a straightforward way to charge the card of the payer.

It is followed up by posting a capture, cancellation or reversal

transaction. An example of a request is provided below. Each individual field of

the JSON document is described in the following section.

Purchase Operation

Posting a payment (operation Purchase) returns the options of aborting the

payment altogether or creating an authorization transaction through the

view-authorization hyperlink, or view-payment.

Request

1

2

3

4

5

{

"payment": {

"operation": "Purchase"

}

}

Card Payment Request

Request

1

2

3

POST /psp/creditcard/payments HTTP/1.1

Authorization: Bearer <AccessToken>

Content-Type: application/json

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

{

"payment": {

"operation": "Purchase",

"intent": "Authorization",

"currency": "SEK",

"prices": [{

"type": "CreditCard",

"amount": 1500,

"vatAmount": 0

}

],

"description": "Test Purchase",

"userAgent": "Mozilla/5.0...",

"language": "sv-SE",

"urls": {

"hostUrls": ["https://example.com"],

"completeUrl": "https://example.com/payment-completed",

"cancelUrl": "https://example.com/payment-cancelled",

"paymentUrl": "https://example.com/perform-payment",

"callbackUrl": "https://example.com/payment-callback",

"logoUrl": "https://example.com/payment-logo.png",

"termsOfServiceUrl": "https://example.com/payment-terms.pdf",

},

"payeeInfo": {

"payeeId": "5cabf558-5283-482f-b252-4d58e06f6f3b",

"payeeReference": "CD1234",

"payeeName": "Merchant1",

"productCategory": "A123",

"orderReference": "or123",

"subsite": "mySubsite"

},

"payer": {

"payerReference": "AB1234",

},

"cardholder": {

"firstName": "Olivia",

"lastName": "Nyhuus",

"email": "olivia.nyhuus@swedbankpay.com",

"msisdn": "+4798765432",

"homePhoneNumber": "+4787654321",

"workPhoneNumber": "+4776543210",

"shippingAddress": {

"firstName": "Olivia",

"lastName": "Nyhuus",

"email": "olivia.nyhuus@swedbankpay.com",

"msisdn": "+4798765432",

"streetAddress": "Saltnestoppen 43",

"coAddress": "",

"city": "Saltnes",

"zipCode": "1642",

"countryCode": "NO"

},

},

"riskIndicator": {

"deliveryEmailAddress": "olivia.nyhuus@swedbankpay.com",

"deliveryTimeFrameIndicator": "01",

"preOrderDate": "19801231",

"preOrderPurchaseIndicator": "01",

"shipIndicator": "01",

"giftCardPurchase": false,

"reOrderPurchaseIndicator": "01",

"pickUpAddress": {

"name": "Olivia Nyhuus",

"streetAddress": "Saltnestoppen 43",

"coAddress": "",

"city": "Saltnes",

"zipCode": "1642",

"countryCode": "NO"

}

}

}

}

| Required | Field | Type | Description |

| :————–: | :——————————– | :———— | :—————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————- |

| check | payment | object | The payment object |

| check | operation | string | Determines the initial operation, defining the type of payment order created. Possible options are Purchase, Abort Verify, UnscheduledPurchase, Recur and Payout. |

| check | intent | string | Authorization. Reserves the amount, and is followed by a Cancel or Capture of funds.

AutoCapture. A one phase option that enables the Capture of funds automatically after authorization. |

| | paymentToken | string | If a paymentToken is included in the request, the card details stored in the paymentToken will be prefilled on the payment page. The payer still has to enter the cvc to complete the purchase. This is called a “One Click” purchase. |

| check | currency | enum(string) | The currency of the payment in the ISO 4217 format (e.g. DKK, EUR, NOK or SEK). Some payment methods are only available with selected currencies. |

| check | prices | array | The prices resource lists the prices related to a specific payment. |

| check | type | string | Use the value ``.See the prices resource for more information. |

| check | amount | integer | The transaction amount (including VAT, if any) entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK. |

| check | vatAmount | integer | The payment’s VAT (Value Added Tax) amount, entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK. The vatAmount entered will not affect the amount shown on the payment page, which only shows the total amount. This field is used to specify how much of the total amount the VAT will be. Set to 0 (zero) if there is no VAT amount charged. |

| check | description | string(40) | A textual description of the purchase. Maximum length is 40 characters. |

| | generatePaymentToken | boolean | true or false. Set this to true if you want to create a paymentToken for future use as One Click. |

| | generateRecurrenceToken | boolean | true or false. Set this to true if you want to create a recurrenceToken for future use Recurring purchases (subscription payments). |

| check | userAgent | string | The user agent of the payer. Should typically be set to the value of the User-Agent header sent by the payer’s web browser. |

| check | language | enum(string) | Allowed locale code values: sv-SE, nb-NO, da-DK, de-DE, et-EE, en-US, es-ES, fr-FR, lv-LV, lt-LT, ru-RU or fi-FI. |

| check︎ | urls | object | The object containing URLs relevant for the payment. |

| check︎ | hostUrls | array | The array of valid host URLs. |

| check | completeUrl | string | The URL that Swedbank Pay will redirect back to when the payer has completed their interactions with the payment. This does not indicate a successful payment, only that it has reached a final (complete) state. A GET request needs to be performed on the payment to inspect it further. See completeUrl for details. |

| check | cancelUrl | string | The URL to redirect the payer to if the payment is cancelled. Only used in redirect scenarios. Can not be used simultaneously with paymentUrl; only cancelUrl or paymentUrl can be used, not both. |

| | paymentUrl | string | The paymentUrl represents the URL that Swedbank Pay will redirect back to when the view-operation needs to be loaded, to inspect and act on the current status of the payment, such as when the payer is redirected out of the Seamless View (the <iframe>) and sent back after completing the payment. paymentUrl is only used in Seamless Views and should point to the page of where the Payment Order Seamless View is hosted. If both cancelUrl and paymentUrl is sent, the paymentUrl will used. |

| | callbackUrl | string | The URL that Swedbank Pay will perform an HTTP POST against every time a transaction is created on the payment. See callback for details. |

| | logoUrl | string | The URL that will be used for showing the customer logo. It must be a picture with maximum 50px height and 400px width. HTTPS is required. |

| | termsOfServiceUrl | string | The URL to the terms of service document which the payer must accept in order to complete the payment. HTTPS is a requirement. |

| check | payeeInfo | object | The payeeInfo object, containing information about the payee (the recipient of the money). See payeeInfo for details. |

| check | payeeId | string | This is the unique id that identifies this payee (like merchant) set by Swedbank Pay. |

| check | payeeReference | string(30) | A unique reference from the merchant system. Set per operation to ensure an exactly-once delivery of a transactional operation. Length and content validation depends on whether the transaction.number or the payeeReference is sent to the acquirer. If Swedbank Pay handles the settlement, the transaction.number is sent to the acquirer and the payeeReference must be in the format of A-Za-z0-9 and string(50). If you handle the settlement, Swedbank Pay will send the payeeReference and it will be limited to the format of string(12). All characters must be digits. |

| | payeeName | string | The payee name (like merchant name) that will be displayed when redirected to Swedbank Pay. |

| | productCategory | string(50) | A product category or number sent in from the payee/merchant. This is not validated by Swedbank Pay, but will be passed through the payment process and may be used in the settlement process. |

| | orderReference | string(50) | The order reference should reflect the order reference found in the merchant’s systems. |

| | subsite | string(40) | The subsite field can be used to perform a split settlement on the payment. The different subsite values must be resolved with Swedbank Pay reconciliation before being used. If you send in an unknown subsite value, it will be ignored and the payment will be settled using the merchant’s default settlement account. Must be in the format of A-Za-z0-9. |

| | payer | string | The payer object, containing information about the payer. |

| | payerReference | string | The reference to the payer from the merchant system, like e-mail address, mobile number, customer number etc. Mandatory if generateRecurrenceToken, RecurrenceToken, generatePaymentToken or paymentToken is true. |

| | metadata | object | A unique reference from the merchant system. Set per operation to ensure an exactly-once delivery of a transactional operation. Length and content validation depends on whether the transaction.number or the payeeReference is sent to the acquirer. If Swedbank Pay handles the settlement, the transaction.number is sent to the acquirer and the payeeReference must be in the format of A-Za-z0-9 and string(50). If you handle the settlement, Swedbank Pay will send the payeeReference and it will be limited to the format of string(12). All characters must be digits. |

| | cardholder | object | Optional. Cardholder object that can hold information about a buyer (private or company). The information added increases the chance for frictionless flow and is related to 3-D Secure 2.0.. |

| | firstName | string | Optional (increased chance for frictionless flow if set). If buyer is a company, use only firstName. |

| | lastName | string | Optional (increased chance for frictionless flow if set). If buyer is a company, use only firstName. |

| | email | string | Optional (increased chance for frictionless flow if set) |

| | msisdn | string | Optional (increased chance for frictionless flow if set) |

| | homePhoneNumber | string | Optional (increased chance for frictionless flow if set) |

| | workPhoneNumber | string | Optional (increased chance for frictionless flow if set) |

| | shippingAddress | object | Optional (increased chance for frictionless flow if set) |

| | firstName | string | Optional (increased chance for frictionless flow if set) |

| | lastName | string | Optional (increased chance for frictionless flow if set) |

| | email | string | Optional (increased chance for frictionless flow if set) |

| | msisdn | string | Optional (increased chance for frictionless flow if set) |

| | streetAddress | string | Optional (increased chance for frictionless flow if set) |

| | coAddress | string | Optional (increased chance for frictionless flow if set) |

| | city | string | Optional (increased chance for frictionless flow if set) |

| | zipCode | string | Optional (increased chance for frictionless flow if set) |

| | countryCode | string | Optional (increased chance for frictionless flow if set) |

| | billingAddress | object | Optional (increased chance for frictionless flow if set) |

| | firstName | string | Optional (increased chance for frictionless flow if set). If buyer is a company, use only firstName. |

| | lastName | string | Optional (increased chance for frictionless flow if set). If buyer is a company, use only firstName. |

| | email | string | Optional (increased chance for frictionless flow if set) |

| | msisdn | string | Optional (increased chance for frictionless flow if set) |

| | streetAddress | string | Optional (increased chance for frictionless flow if set) |

| | coAddress | string | Optional (increased chance for frictionless flow if set) |

| | city | string | Optional (increased chance for frictionless flow if set) |

| | zipCode | string | Optional (increased chance for frictionless flow if set) |

| | countryCode | string | Optional (increased chance for frictionless flow if set) |

riskIndicator

array

deliveryEmailAdress

string

deliveryTimeFrameIndicator

string

`01` (Electronic Delivery)

`02` (Same day shipping)

`03` (Overnight shipping)

`04` (Two-day or more shipping)

preOrderDate

string

preOrderPurchaseIndicator

string

`01` (Merchandise available)

`02` (Future availability)

shipIndicator

string

`01` (Ship to cardholder's billing address)

`02` (Ship to another verified address on file with merchant)

`03` (Ship to address that is different than cardholder's billing address)

`04` (Ship to Store / Pick-up at local store. Store address shall be populated in shipping address fields)

`05` (Digital goods, includes online services, electronic giftcards and redemption codes)

`06` (Travel and Event tickets, not shipped)

`07` (Other, e.g. gaming, digital service)

giftCardPurchase

bool

reOrderPurchaseIndicator

string

`01` (First time ordered)

`02` (Reordered).

pickUpAddress

object

name

string

streetAddress

string

coAddress

string

city

string

zipCode

string

countryCode

string

Card Payment Response

Response

1

2

HTTP/1.1 200 OK

Content-Type: application/json

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

{

"payment": {

"id": "/psp/creditcard/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1",

"number": 1234567890,

"instrument": "CreditCard",

"created": "2016-09-14T13:21:29.3182115Z",

"updated": "2016-09-14T13:21:57.6627579Z",

"state": "Ready",

"operation": "Purchase",

"intent": "Authorization",

"currency": "SEK",

"amount": 0,

"remainingCaptureAmount": 1500,

"remainingCancellationAmount": 1500,

"remainingReversalAmount": 0,

"description": "Test Purchase",

"initiatingSystemUserAgent": "swedbankpay-sdk-dotnet/3.0.1",

"userAgent": "Mozilla/5.0...",

"language": "sv-SE",

"prices": { "id": "/psp/creditcard/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/prices" },

"transactions": { "id": "/psp/creditcard/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/transactions" },

"authorizations": { "id": "/psp/creditcard/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/authorizations" },

"captures": { "id": "/psp/creditcard/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/captures" },

"reversals": { "id": "/psp/creditcard/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/reversals" },

"cancellations": { "id": "/psp/creditcard/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/cancellations" },

"urls": { "id": "/psp/creditcard/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/urls" },

"payeeInfo": { "id": "/psp/creditcard/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/payeeInfo" },

"payers": { "id": "/psp/creditcard/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/payers" },

"settings": { "id": "/psp/creditcard/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/settings" }

},

"operations": [

{

"rel": "update-payment-abort",

"href": "https://api.externalintegration.payex.com/psp/creditcard/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1",

"method": "PATCH",

"contentType": "application/json"

},

{

"rel": "redirect-authorization",

"href": "https://ecom.externalintegration.payex.com/creditcard/payments/authorize/5a17c24e-d459-4567-bbad-aa0f17a76119",

"method": "GET",

"contentType": "text/html"

},

{

"rel": "view-authorization",

"href": "https://ecom.externalintegration.payex.com/creditcard/core/scripts/client/px.creditcard.client.js?token=5a17c24e-d459-4567-bbad-aa0f17a76119",

"method": "GET",

"contentType": "application/javascript"

},

{

"rel": "view-payment",

"href": "https://ecom.externalintegration.payex.com/creditcard/core/scripts/client/px.creditcard.client.js?token=5a17c24e-d459-4567-bbad-aa0f17a76119",

"method": "GET",

"contentType": "application/javascript"

},

{

"rel": "direct-authorization",

"href": "https://api.externalintegration.payex.com/psp/creditcard/confined/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1/authorizations",

"method": "POST",

"contentType": "application/json"

}

]

}

| Field | Type | Description |

|---|---|---|

payment |

object |

The payment object contains information about the specific payment. |

id |

string |

The relative URL and unique identifier of the payment resource . Please read about URL Usage to understand how this and other URLs should be used in your solution. |

number |

integer |

The payment number, useful when there’s need to reference the payment in human communication. Not usable for programmatic identification of the payment, where id should be used instead. |

created |

date(string) |

The ISO 8601 date and time when the payment was created. |

updated |

date(string) |

The ISO 8601 date and time when the payment was updated. |

state |

string |

Ready, Pending, Failed or Aborted. Indicates the state of the payment, not the state of any transactions performed on the payment. To find the state of the payment’s transactions (such as a successful authorization), see the transactions resource or the different specialized type-specific resources such as authorizations or sales. |

prices |

object |

The prices resource lists the prices related to a specific payment. |

id |

string |

The relative URL and unique identifier of the prices resource . Please read about URL Usage to understand how this and other URLs should be used in your solution. |

amount |

integer |

The transaction amount (including VAT, if any) entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK. |

remainingCaptureAmount |

integer |

The available amount to capture. |

remainingCancelAmount |

integer |

The available amount to cancel. |

remainingReversalAmount |

integer |

The available amount to reverse. |

description |

string(40) |

A textual description of the purchase. Maximum length is 40 characters. |

userAgent |

string |

The user agent of the payer. Should typically be set to the value of the User-Agent header sent by the payer’s web browser. |

language |

enum(string) |

Allowed locale code values: sv-SE, nb-NO, da-DK, de-DE, et-EE, en-US, es-ES, fr-FR, lv-LV, lt-LT, ru-RU or fi-FI. |

urls |

string |

The URL to the urls resource where all URLs related to the payment can be retrieved. |

payeeInfo |

object |

The payeeInfo object, containing information about the payee (the recipient of the money). See payeeInfo for details. |

payers |

string |

The URL to the payer resource where the information about the payer can be retrieved. |

operations |

array |

The array of operations that are possible to perform on the payment in its current state. |

method |

string |

The HTTP method to use when performing the operation. |

href |

string |

The target URL to perform the operation against. |

rel |

string |

The name of the relation the operation has to the current resource. |

The key information in the response is the view-authorization operation. You

will need to embed its href in a <script> element. The script will enable

loading the payment page in an iframe in our next step.

Please note that nested iframes (an iframe within an iframe) are unsupported.

Step 2: Display The Payment

You need to embed the script source on your site to create a Seamless View in an

iframe; so that the payer can enter the credit card details in a secure Swedbank Pay

hosted environment. A simplified integration has these following steps:

- Create a container that will contain the Seamless View iframe:

<div id="swedbank-pay-seamless-view-page">. - Create a

<script>source within the container. Embed thehrefvalue obtained in thePOSTrequest in the<script>element. Example:

1

<script id="payment-page-script" src="https://ecom.externalintegration.payex.com/creditcard/core/ scripts/client/px.creditcard.client.js"></script>

The previous two steps gives this HTML:

HTML

1

2

3

4

5

6

7

8

9

10

11

12

13

<!DOCTYPE html>

<html>

<head>

<title>Swedbank Pay Seamless View is Awesome!</title>

<!-- Here you can specify your own javascript file -->

<script src=<YourJavaScriptFileHere>></script>

</head>

<body>

<div id="swedbank-pay-seamless-view-page">

<script id="payment-page-script" src="https://ecom.dev.payex.com/creditcard/core/scripts/client/px.creditcard.client.js"></script>

</div>

</body>

</html>

Load The Seamless View

Lastly, initiate the Seamless View with a JavaScript call to open the iframe

embedded on your website.

JavaScript

1

2

3

4

5

6

7

<script language="javascript">

payex.hostedView.creditCard({

// The container specifies which id the script will look for to host the

// iframe component.

container: "swedbank-pay-seamless-view-page"

}).open();

</script>

Monitoring The Script URL

If you choose to stay with Seamless View, please take the following under advisement.

To ensure compliance, we recommend implementing Content Security Policy rules to monitor and authorize scripts.

Merchants must whitelist the following domains to restrict browser content retrieval to approved sources. While https://.payex.com and https://.swedbankpay.com cover most payment methods, digital wallets such as Apple Pay, Click to Pay, and Google Pay are delivered via Payair. Alongside the Payair URL, these wallets may also generate URLs from Apple, Google, MasterCard, and Visa. See the table below for more information.

When it comes to ACS URLs, nothing is loaded from the ACS domain in the merchant’s end. It will either happen within Swedbank Pay’s domain or as a redirect, which will repeal the merchant’s CSP.

The list below includes important URLs, but may not be exhaustive. Merchants need to stay up to date in case of URL changes, or if you need to whitelist URLs not listed here.

For further details, refer to section 4.6.3 and 11.6.1 in this PCI-DSS document.

| URL | Description |

|---|---|

| https://*.cdn-apple.com | URL needed for Apple Pay. |

| https://*.google.com | URL needed for Google Pay. |

| https://*.gstatic.com | Domain used by Google that hosts images, CSS, and javascript code to reduce bandwidth usage online. |

| https://*.mastercard.com | URL needed for Click to Pay. |

| https://*.payair.com | URL for the digital wallets Apple Pay, Click to Pay and Google Pay. |

| https://*.payex.com | Universal URL for all payment methods except the digital wallets Apple Pay, Click to Pay and Google Pay. |

| https://*.swedbankpay.com | Universal URL for all payment methods except the digital wallets Apple Pay, Click to Pay and Google Pay. |

| https://*.visa.com | URL needed for Click to Pay. |

Events

When a user actively attempts to perform a payment, the onPaymentCreated event

is raised with the following event argument object:

onPaymentCreated event object

onPaymentCreated event object

1

2

HTTP/1.1 200 OK

Content-Type: application/json

1

2

3

4

{

"id": "/psp/creditcard/payments/7e6cdfc3-1276-44e9-9992-7cf4419750e1",

"instrument": "creditcard",

}

| Field | Type | Description |

|---|---|---|

id |

string |

The relative URL and unique identifier of the payment resource . Please read about URL Usage to understand how this and other URLs should be used in your solution. |

instrument |

string |

creditcard |

Sequence Diagram

sequenceDiagram

participant Payer

participant Merchant

participant SwedbankPay as Swedbank Pay

activate Payer

Payer->>-Merchant: Start purchase

activate Merchant

note left of Payer: First API request

Merchant->>-SwedbankPay: POST /psp/creditcard/payments

activate SwedbankPay

SwedbankPay-->>-Merchant: rel: view-authorization ①

activate Merchant

Merchant-->>-Payer: Authorization page

activate Payer

note left of Payer: Open iframe ②

Payer->>Payer: Input creditcard information

Payer->>-SwedbankPay: Show Consumer UI page in iframe - Authorization ③

activate SwedbankPay

opt If 3-D Secure is required

SwedbankPay-->>-Payer: Redirect to IssuingBank

activate Payer

Payer->>IssuingBank: 3-D Secure authentication process

activate IssuingBank

IssuingBank-->>-Payer: 3-D Secure authentication process response

Payer->>-IssuingBank: Access authentication page

activate IssuingBank

IssuingBank -->>+Payer: Redirect to PaymentUrl

Payer->>-Merchant: Redirect back to PaymentUrl (merchant)

end

alt Callback is set

activate SwedbankPay

SwedbankPay->>SwedbankPay: Payment is updated

SwedbankPay->>-Merchant: POST Payment Callback

end

SwedbankPay-->>Merchant: Event: OnPaymentComplete ④

activate Merchant

note left of Merchant: Second API request.

Merchant->>-SwedbankPay: GET <payment.id>

activate SwedbankPay

SwedbankPay-->>-Merchant: rel: view-payment

activate Merchant

Merchant-->>-Payer: Display purchase result

activate Payer

3-D Secure

No 3-D Secure and card acceptance: There are optional parameters which can be used in relation to 3-D Secure and card acceptance. Most acquiring agreements will demand that you use 3-D Secure for card holder authentication. However, if your agreement allows you to make a card payment without this authentication, or that specific cards can be declined, you may adjust these optional parameters when posting in the payment.

Swedbank Pay will handle 3-D Secure authentication when this is required. When dealing with credit card payments, 3-D Secure authentication of the cardholder is an essential topic. There are two alternative outcomes of a credit card payment:

- 3-D Secure enabled - by default, 3-D Secure should be enabled, and Swedbank Pay will check if the card is enrolled with 3-D Secure. This depends on the issuer of the card. If the card is not enrolled with 3-D Secure, no authentication of the cardholder is done.

- Card supports 3-D Secure - if the card is enrolled with 3-D Secure, Swedbank Pay will redirect the cardholder to the autentication mechanism that is decided by the issuing bank. Normally this will be done using BankID or Mobile BankID.

Explanations

- ①

rel: view-authorizationis a value in one of the operations, sent as a response from Swedbank Pay to the Merchant. - ②

Open iframecreates the Swedbank Pay hosted iframe. - ③

Show Payer UI page in iframedisplays the payment window as content inside of the iframe. The payer can enter card information for authorization. - ④

Event: OnPaymentCompleteis when a payment is complete. Please note that both successful and rejected payments reach completion, in contrast to a cancelled payment.