Swish is the main Swedish payment app for mobile phones supported by all Swedish banks, making it one of the essential payment methods for merchants operating in Sweden. According to Kantar Sifo, it is the preferred online payment method in the age group 18-40, and the payment method with the best conversion rates.

We offer both desktop and mobile phone payment flows in our Redirect and Seamless View integrations, in addition to Direct API and Payment Link. Three flexible ways of integrating, two conversion optimized payment flows. Using the Direct API integration will put you in charge of determining which device is being used, and whether the e- or m-commerce flow is the most suitable. We will do this for you in Redirect and Seamless view.

Payment Flow

The following is a quick presentation of the purchase flow when using the Redirect or Seamless view. You can find in-depth descriptions of the separate flows in the corresponding sections.

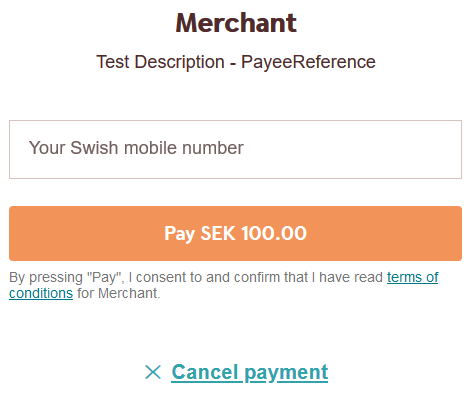

In the desktop intended e-commerce flow, the payer enters a Swish connected

mobile phone number on Swedbank Pay’s payment page (Redirect) or in the iframe

(Seamless View) after the payment is created.

After pushing the pay button, the payer needs to open the Swish app and confirm the payment. If you are using the Redirect option, the payer will be Redirected back to the merchant’s site.

In the mobile phone intended m-commerce flow, the payment page or iframe will

only have a pay button, and no mobile phone number input is needed.

The Swish app will be launched automatically when you push the pay button.

Good To Know

Intent

The intent of the payment identifies how and when the charge will be effectuated. This determines the type of transaction used during the payment process.

-

Sale(one-phase): Thesaleintent is used by the payment methods like Swish, where the funds are reserved and drawn from the payer’s account immediately. This means you don’t need to do any more financial operations to fulfill the transaction. The only available after payment operation isreversal.

Payment Type

Swish is one of the payment methods using one-phase payments. The sale is done

when the payer successfully confirms in the app, capturing the funds

instantly. The abort operation is still available, but the cancel and

capture operations are not. The reversal, if needed, is done by the

merchant at a later time. Read more about the different

operations and the payment resource.

Certificate

We recommend that you apply for Swish as part of our Settlement Service and utilize our Technical Supplier Certificate. A Swedbank Pay sales representative can assist you with this. The Settlement Service will provide you with aggregated and reconciled reports and payments. The Technical Supplier Certificate means setup will be quicker and you will not have to assign a point of contact to monitor and renew a certificate.

You could also contact one of the following banks offering Swish Handel: Danske Bank, SEB, lansforsakringar, Sparbanken Syd, Sparbanken Öresund, Nordea, Handelsbanken, in order to get an acquiring agreement, a Swish alias and access to Swish Certificate Management system (several banks do however support Technical Supplier Certificate setups so you can ask them for that).

Demoshop

You can give Swish a go in our demoshop if you like. For Redirect payments, you

need to toggle paymentUrl off, if you want to try Seamless View, paymentUrl

must be toggled on. The external integration demoshop used for testing is set up

with the Merchant Swish Simulator, which enables you to test without using the

Swish App.

This payment methods supports English (US) en-US, Norwegian nb-NO and

Swedish sv-SE.