MobilePay is the main payment app in Denmark and one of the leading apps in Finland, making it one of the essential payment methods for merchants operating in these Nordic countries. More than 4.2 million Danes and Finns use the app and 140,000 stores are accepting payments. We offer it on our redirect and seamless view platforms.

How It Looks

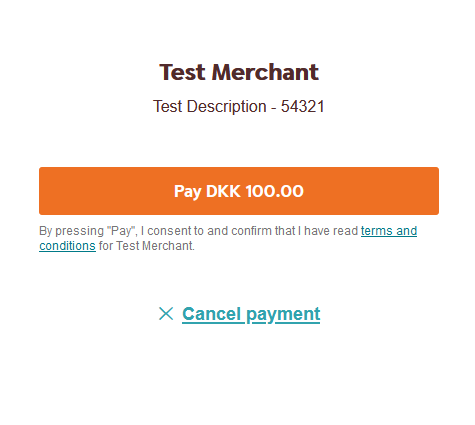

When the payment is created, the payer is redirected to a Swedbank Pay landing page where they can proceed with the payment by pressing the pay button.

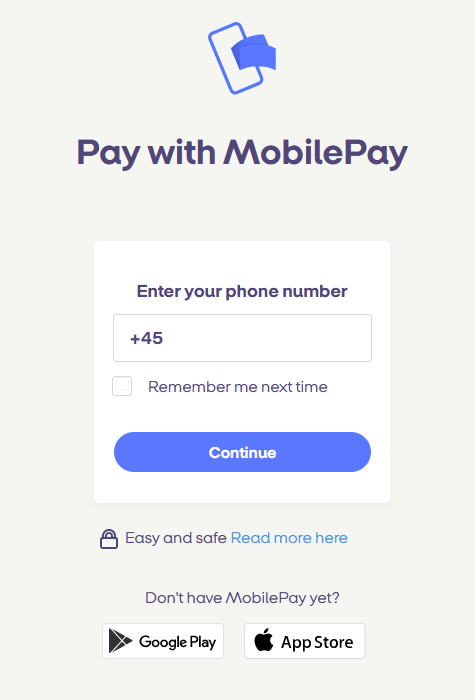

This takes the payer to MobilePay’s own payment page where the phone number is entered, and a push message is sent to the phone.

A countdown is shown in the browser and the payment request will appear in the app, waiting to be confirmed by the payer. If you are using the redirect option, the payer will be redirected back to the merchant’s site.

Intent

Authorization (two-phase): The intent of a MobilePay Online purchase is

always Authorization. The amount will be reserved but not charged. You will

later (i.e. if a physical product, when you are ready to ship the purchased

products) have to make a Capture or

Cancel request.

Payment Type

MobilePay Online is one of the payment methods using two-phase payments. The

authorization is done when the payer successfully confirms in the app, and

the abort, cancel, capture or reversal is done by the merchant at a

later time. Read more about the different operations and the

payment resource.

Two-phase payments: When dealing in physical goods using two-phase payment methods, all goods must be shipped before you capture the authorized amount. This is regulated in part by the Swedish Distance and Doorstep Sales Act, required in our terms and (for card payments) required by Visa and Mastercard.

Settlement

MobilePay Online transactions are handled, processed and settled as card transactions in our system. They are, however, tagged as MobilePay Online transactions and have their own acquirer agreement, so the two payment methods are settled separately.

3-D Secure

As MobilePay Online transactions are processed as card transactions, a 3-D Secure agreement is needed to complete the payment method setup. This information is provided to you by your acquirer when you set up your agreement with them. If you offer both Card Payments and MobilePay Online, you will need two separate 3-D Secure agreements, one for each payment method. Apart from the agreement with the acquirer, no further 3-D Secure compliance is required from you as a merchant in this regard.

Languages supported by this payment method are Danish da-DK, English (US)

en-US and Finnish fi-FI.

Payment Availability

Even though MobilePay Online supports several currencies, the payment method itself is only available for payers in Denmark and Finland. This allows a shop in Norway to receive payments in NOK from a Danish payer if the shop supports shipping to Denmark, for instance.