Integration options: We advise you to integrate our Mobile SDK Payment Menu instead of integrating card payments directly in your app with WebView.

Card Payments In Mobile Apps

The implementation sequence for Card Payments in mobile apps is identical to the standard Redirect scenario, but also includes explanations of how to include this redirect in mobile apps or in mobile web pages.

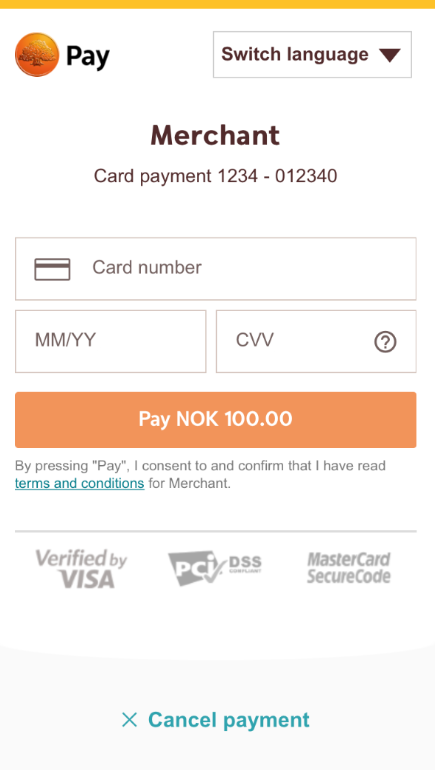

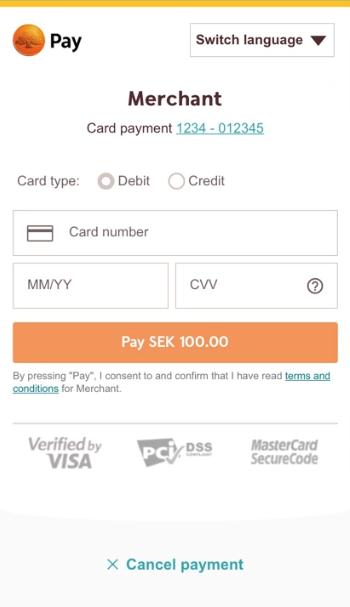

How It Looks

You will redirect the payer to Swedbank Pay hosted pages to collect the card information.

Transactions in SEK will have an option for selecting debit or credit card:

API Requests For Payments

The API requests are displayed in the purchase flow.

You can create a card payment with following operation

options:

Our payment example below uses the Purchase value.

Sequence Diagram For Mobile

The sequence diagram below shows a high level description of a complete purchase, and the two requests you have to send to Swedbank Pay. The links will take you directly to the corresponding API description.

When dealing with card payments, 3-D Secure authentication of the cardholder is an essential topic. There are two alternative outcomes of a credit card payment:

- 3-D Secure enabled - by default, 3-D Secure should be enabled, and Swedbank Pay will check if the card is enrolled with 3-D Secure. This depends on the issuer of the card. If the card is not enrolled with 3-D Secure, no authentication of the cardholder is done.

- Card supports 3-D Secure - if the card is enrolled with 3-D Secure, Swedbank Pay will redirect the cardholder to the autentication mechanism that is decided by the issuing bank. Normally this will be done using BankID or Mobile BankID.

sequenceDiagram

participant Payer

participant Merchant

participant SwedbankPay as Swedbank Pay

activate Payer

Payer->>-Merchant: start purchase

activate Merchant

Merchant->>-SwedbankPay: POST /psp/creditcard/payments

activate SwedbankPay

note left of Merchant: First API Request

SwedbankPay-->>-Merchant: payment resource

activate Merchant

Merchant-->>-Payer: authorization page

activate Payer

note left of Payer: redirect to SwedbankPay

Payer->>-Merchant: access merchant page

activate Merchant

Merchant->>-SwedbankPay: GET <payment.id>

activate SwedbankPay

note left of Merchant: Second API request

SwedbankPay-->>-Merchant: rel: redirect-authorization

activate Merchant

Merchant-->>-Payer: display purchase result

sequenceDiagram

participant Payer

participant Merchant

participant SwedbankPay as Swedbank Pay

activate Payer

Payer->>-Merchant: start purchase

activate Payer

Merchant->>-SwedbankPay: POST /psp/creditcard/payments

activate Merchant

note left of Payer: First API request

SwedbankPay-->-Merchant: payment resource

activate SwedbankPay

Merchant-->>-Payer: authorization page

activate Merchant

Payer->>-SwedbankPay: access authorization page

activate Payer

note left of Payer: redirect to SwedbankPay

SwedbankPay-->>-Payer: display purchase information

activate SwedbankPay

Payer->>Payer: input creditcard information

Payer->>-SwedbankPay: submit creditcard information

activate Payer

opt Card supports 3-D Secure

SwedbankPay-->>-Payer: redirect to IssuingBank

activate SwedbankPay

Payer->>IssuingBank: 3-D Secure authentication process

Payer->>-SwedbankPay: access authentication page

activate Payer

end

SwedbankPay-->>-Payer: redirect to merchant

activate SwedbankPay

note left of Payer: redirect back to merchant

Payer->>-Merchant: access merchant page

activate Payer

Merchant->>-SwedbankPay: GET <payment.id>

activate Merchant

note left of Merchant: Second API request

SwedbankPay-->>-Merchant: rel: redirect-authorization

activate SwedbankPay

Merchant-->>Payer: display purchase result

activate Merchant

opt Callback is set

activate SwedbankPay

SwedbankPay->>SwedbankPay: Payment is updated

SwedbankPay->>Merchant: POST Payment Callback

activate SwedbankPay

end