The Enterprise Seamless View integration consists of three main steps. Creating the payment order, displaying the payment menu in an iframe, and capturing the funds. In addition, there are other post-purchase options you need. We get to them later on.

Step 1: Create Payment Order

When the payer has been checked in and the purchase initiated, you need to create a payment order.

Start by performing a POST request towards the paymentorder resource

with payer information and a completeUrl.

We have added productName to the payment order request in this integration.

You can find it in the paymentorder field. This is required if you want to use

Online Payments. If it isn´t included in your request, you won’t get the

correct operations in the response.

When productName is set to checkout3, digitalProducts will be set to

false by default.

Supported features for this integration are subscriptions (recur and

unscheduled MIT), instrument mode and split settlement (subsite).

There is also a guest mode option for the payers who don’t wish to store their

information. When using Enterprise, the way to trigger

this is to not include the payerReference or nationalIdentifier field in

your paymentOrder request. You find them in the payer field in the example

below.

Sometimes you might need to abort purchases. An example could be if a payer does

not complete the purchase within a reasonable timeframe. For those instances we

have abort, which you can read about in the core features.

You can only use abort if the payer has not completed an authorize or a

sale.

Payment Url

For our Seamless Views, the field called paymentUrl will be used when the

payer is redirected out of the Seamless View (the iframe). The payer is

redirected out of frame when selecting payment methods which trigger SCA.

This includes 3-D Secure card payments, installment account, invoice, MobilePay,

monthly invoice payments, Trustly and Vipps.

The URL should represent the page of where the Payment Order Seamless View was

hosted originally, such as the checkout page, shopping cart page, or similar.

Basically, paymentUrl should be set to the same URL as that of the page where

the JavaScript for the Seamless View was added to in order to initiate the

payment process.

Please note that the paymentUrl must be able to invoke the same JavaScript URL

from the same Payment Order as the one that initiated the payment process

originally, so it should include some sort of state identifier in the URL. The

state identifier is the ID of the order, shopping cart or similar that has the

URL of the Payment stored.

With paymentUrl in place, the retry process becomes much more convenient for

both the integration and the payer.

To minimize the risk for

a challenge request (Strong Customer Authentication – “SCA”) on card payments,

it’s recommended that you add as much data as possible to the riskIndicator

object in the request below.

GDPR: GDPR

sensitive data such as email, phone numbers and social security numbers must

not be used directly in request fields such as payerReference. If it is

necessary to use GDPR sensitive data, it must be hashed and then the hash can be

used in requests towards Swedbank Pay.

Payment Order Request

Request

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

POST /psp/paymentorders HTTP/1.1

Host: api.externalintegration.payex.com

Authorization: Bearer <AccessToken>

Content-Type: application/json

{

"paymentorder": {

"operation": "Purchase",

"currency": "SEK",

"amount": 1500,

"vatAmount": 375,

"description": "Test Purchase",

"userAgent": "Mozilla/5.0",

"language": "sv-SE",

"productName": "Checkout3",

"urls": {

"hostUrls": [ "https://example.com", "https://example.net" ],

"paymentUrl": "https://example.com/perform-payment",

"completeUrl": "https://example.com/payment-completed",

"cancelUrl": "https://example.com/payment-cancelled",

"callbackUrl": "https://api.example.com/payment-callback",

"termsOfServiceUrl": "https://example.com/termsandconditions.pdf"

},

"payeeInfo": {

"payeeId": "5cabf558-5283-482f-b252-4d58e06f6f3b",

"payeeReference": "AB832",

"payeeName": "Merchant1",

"productCategory": "A123",

"orderReference": "or-123456",

"subsite": "MySubsite",

"siteId": "MySiteId"

},

"payer": {

"digitalProducts": false,

"nationalIdentifier": {

"socialSecurityNumber": "199710202392",

"countryCode": "SE"

},

"firstName": "Leia",

"lastName": "Ahlström",

"email": "leia@swedbankpay.com",

"msisdn": "+46787654321",

"payerReference": "AB1234",

"shippingAddress": {

"firstName": "firstname/companyname",

"lastName": "lastname",

"email": "karl.anderssson@mail.se",

"msisdn": "+46759123456",

"streetAddress": "Helgestavägen 9",

"coAddress": "",

"city": "Solna",

"zipCode": "17674",

"countryCode": "SE"

},

"billingAddress": {

"firstName": "firstname/companyname",

"lastName": "lastname",

"email": "karl.anderssson@mail.se",

"msisdn": "+46759123456",

"streetAddress": "Helgestavägen 9",

"coAddress": "",

"city": "Solna",

"zipCode": "17674",

"countryCode": "SE"

},

"accountInfo": {

"accountAgeIndicator": "04",

"accountChangeIndicator": "04",

"accountPwdChangeIndicator": "01",

"shippingAddressUsageIndicator": "01",

"shippingNameIndicator": "01",

"suspiciousAccountActivity": "01"

}

},

"orderItems": [

{

"reference": "P1",

"name": "Product1",

"type": "PRODUCT",

"class": "ProductGroup1",

"itemUrl": "https://example.com/products/123",

"imageUrl": "https://example.com/product123.jpg",

"description": "Product 1 description",

"discountDescription": "Volume discount",

"quantity": 5,

"quantityUnit": "pcs",

"unitPrice": 300,

"discountPrice": 0,

"vatPercent": 2500,

"amount": 1500,

"vatAmount": 375

}

],

"riskIndicator": {

"deliveryEmailAddress": "olivia.nyhuus@swedbankpay.com",

"deliveryTimeFrameIndicator": "01",

"preOrderDate": "19801231",

"preOrderPurchaseIndicator": "01",

"shipIndicator": "01",

"giftCardPurchase": false,

"reOrderPurchaseIndicator": "01",

"pickUpAddress": {

"name": "Olivia Nyhus",

"streetAddress": "Saltnestoppen 43",

"coAddress": "",

"city": "Saltnes",

"zipCode": "1642",

"countryCode": "NO"

}

}

}

}

paymentOrder

object

check

operation

string

check

Determines the initial operation, defining the type of payment order created. Possible options are Purchase, Abort Verify, UnscheduledPurchase, Recur and Payout.

currency

enum(string)

check

DKK, EUR, NOK or SEK). Some payment methods are only available with selected currencies.

amount

integer

check

The transaction amount (including VAT, if any) entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK.

vatAmount

integer

check

The payment’s VAT (Value Added Tax) amount, entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK. The vatAmount entered will not affect the amount shown on the payment page, which only shows the total amount. This field is used to specify how much of the total amount the VAT will be. Set to 0 (zero) if there is no VAT amount charged.

description

string

check

userAgent

string

check

The user agent of the payer. Should typically be set to the value of the User-Agent header sent by the payer’s web browser.

language

enum(string)

check

productName

string

check

implementation

string

urls

object

check

urls object, containing the URLs relevant for the payment order.

hostUrls

array

check

paymentUrl

string

The paymentUrl represents the URL that Swedbank Pay will redirect back to when the view-operation needs to be loaded, to inspect and act on the current status of the payment, such as when the payer is redirected out of the Seamless View (the <iframe>) and sent back after completing the payment. paymentUrl is only used in Seamless Views and should point to the page of where the Payment Order Seamless View is hosted. If both cancelUrl and paymentUrl is sent, the paymentUrl will used. Trustly will only be available if the paymentUrl is provided while using Seamless View. When using Redirect, Trustly will appear regardless.

completeUrl

string

check

The URL that Swedbank Pay will redirect back to when the payer has completed their interactions with the payment. This does not indicate a successful payment, only that it has reached a final (complete) state. A GET request needs to be performed on the payment order to inspect it further. See completeUrl for details.

cancelUrl

string

abort request of the payment or paymentorder.

callbackUrl

string

The URL that Swedbank Pay will perform an HTTP POST against every time a transaction is created on the payment order. See callback for details.

termsOfServiceUrl

string

check

The URL to the terms of service document which the payer must accept in order to complete the payment. HTTPS is a requirement.

payeeInfo

object

check

The payeeInfo object, containing information about the payee (the recipient of the money). See payeeInfo for details.

payeeId

string

check

payeeReference

string(30)

check

A unique reference from the merchant system. Set per operation to ensure an exactly-once delivery of a transactional operation. Length and content validation depends on whether the transaction.number or the payeeReference is sent to the acquirer. If Swedbank Pay handles the settlement, the transaction.number is sent to the acquirer and the payeeReference must be in the format of A-Za-z0-9 and string(30). If you handle the settlement, Swedbank Pay will send the payeeReference and it will be limited to the format of string(12). All characters must be digits. In Invoice Payments payeeReference is used as an invoice/receipt number, if the receiptReference is not defined.

payeeName

string

productCategory

string(50)

orderReference

string(50)

subsite

string(40)

The subsite field can be used to perform a split settlement on the payment. The different subsite values must be resolved with Swedbank Pay reconciliation before being used. If you send in an unknown subsite value, it will be ignored and the payment will be settled using the merchant’s default settlement account. Must be in the format of A-Za-z0-9.

siteId

string(15)

siteId is used for split settlement transactions when you, as a merchant, need to specify towards AMEX which sub-merchant the transaction belongs to. Must be in the format of A-Za-z0-9.

payer

object

payer object containing information about the payer relevant for the payment order.

digitalProducts

bool

true for merchants who only sell digital goods and only require email and/or msisdn as shipping details. Set to false if the merchant also sells physical goods.

nationalIdentifier

object

socialSecurityNumber

string

countryCode

string

firstName

string

lastName

string

email

string

msisdn

string

payerReference

string

shippingAddress

object

payer. The field is related to 3-D Secure 2 .

firstName

string

lastName

string

streetAddress

string

coAddress

string

zipCode

string

city

string

countryCode

string

billingAddress

object

firstName

string

lastName

string

streetAddress

string

coAddress

string

zipCode

string

city

string

countryCode

string

SE, NO, or FI.

accountInfo

object

payer containing info about the payer's account.

accountAgeIndicator

string

01 (No account, guest checkout) 02 (Created during this transaction) 03 (Less than 30 days old) 04 (30 to 60 days old) 05 (More than 60 days old)

accountChangeIndicator

string

01 (Changed during this transaction) 02 (Less than 30 days ago) 03 (30 to 60 days ago) 04 (More than 60 days ago)

accountChangePwdIndicator

string

01 (No changes) 02 (Changed during this transaction) 03 (Less than 30 days ago) 04 (30 to 60 days ago) 05 (More than 60 days old)

shippingAddressUsageIndicator

string

01(This transaction) 02 (Less than 30 days ago) 03 (30 to 60 days ago) 04 (More than 60 days ago)

shippingNameIndicator

string

01 (Account name identical to shipping name) 02 (Account name different from shipping name)

suspiciousAccountActivity

string

01 (No suspicious activity has been observed) 02 (Suspicious activity has been observed)

orderItems

array

check

The array of items being purchased with the order. Note that authorization orderItems will not be printed on invoices, so lines meant for print must be added in the Capture request. The authorization orderItems will, however, be used in the Merchant Portal when captures or reversals are performed, and might be shown other places later. It is required to use this field to be able to send Capture orderItems. Capture requests should only contain items meant to be captured from the order.

reference

string

check

name

string

check

type

string

check

PRODUCT, SERVICE, SHIPPING_FEE, PAYMENT_FEE DISCOUNT, VALUE_CODE or OTHER. The type of the order item. PAYMENT_FEE is the amount you are charged with when you are paying with invoice. The amount can be defined in the amount field below.

class

string

check

MobilePhone. Note that class cannot contain spaces and must follow the regex pattern [\w-]*. Swedbank Pay may use this field for statistics.

itemUrl

string

imageUrl

string

description

string

A textual description of the purchase. Maximum length is 40 characters.

discountDescription

string

quantity

number

check

quantityUnit

string

check

pcs, grams, or similar. This is used for your own book keeping.

unitPrice

integer

check

discountPrice

integer

vatPercent

integer

check

25% becomes 2500.

amount

integer

check

The transaction amount (including VAT, if any) entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK.

vatAmount

integer

check

The payment’s VAT (Value Added Tax) amount, entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK. The vatAmount entered will not affect the amount shown on the payment page, which only shows the total amount. This field is used to specify how much of the total amount the VAT will be. Set to 0 (zero) if there is no VAT amount charged.

riskIndicator

array

deliveryEmailAdress

string

deliveryTimeFrameIndicator

string

`01` (Electronic Delivery)

`02` (Same day shipping)

`03` (Overnight shipping)

`04` (Two-day or more shipping)

preOrderDate

string

preOrderPurchaseIndicator

string

`01` (Merchandise available)

`02` (Future availability)

shipIndicator

string

`01` (Ship to cardholder's billing address)

`02` (Ship to another verified address on file with merchant)

`03` (Ship to address that is different than cardholder's billing address)

`04` (Ship to Store / Pick-up at local store. Store address shall be populated in shipping address fields)

`05` (Digital goods, includes online services, electronic giftcards and redemption codes)

`06` (Travel and Event tickets, not shipped)

`07` (Other, e.g. gaming, digital service)

giftCardPurchase

bool

reOrderPurchaseIndicator

string

`01` (First time ordered)

`02` (Reordered).

pickUpAddress

object

name

string

streetAddress

string

coAddress

string

city

string

zipCode

string

countryCode

string

Payment Order Response

Response

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

HTTP/1.1 200 OK

Content-Type: application/json

{

"paymentorder": {

"id": "/psp/paymentorders/09ccd29a-7c4f-4752-9396-12100cbfecce",

"created": "2020-06-22T10:56:56.2927632Z",

"updated": "2020-06-22T10:56:56.4035291Z",

"operation": "Purchase",

"status": "Initialized",

"currency": "SEK",

"amount": 1500,

"vatAmount": 375,

"description": "Test Purchase",

"initiatingSystemUserAgent": "swedbankpay-sdk-dotnet/3.0.1",

"language": "sv-SE",

"availableInstruments": [

"CreditCard",

"Invoice-PayExFinancingSe",

"Invoice-PayMonthlyInvoiceSe",

"Swish",

"CreditAccount",

"Trustly" ],

"implementation": "Enterprise",

"integration": "HostedView",

"instrumentMode": false,

"guestMode": false,

"payer": {

"id": "/psp/paymentorders/8be318c1-1caa-4db1-e2c6-08d7bf41224d/payers"

},

"orderItems": {

"id": "/psp/paymentorders/09ccd29a-7c4f-4752-9396-12100cbfecce/orderitems"

},

"history": {

"id": "/psp/paymentorders/8be318c1-1caa-4db1-e2c6-08d7bf41224d/history"

},

"failed": {

"id": "/psp/paymentorders/8be318c1-1caa-4db1-e2c6-08d7bf41224d/failed"

},

"aborted": {

"id": "/psp/paymentorders/8be318c1-1caa-4db1-e2c6-08d7bf41224d/aborted"

},

"paid": {

"id": "/psp/paymentorders/8be318c1-1caa-4db1-e2c6-08d7bf41224d/paid"

},

"cancelled": {

"id": "/psp/paymentorders/8be318c1-1caa-4db1-e2c6-08d7bf41224d/cancelled"

},

"financialTransactions": {

"id": "/psp/paymentorders/8be318c1-1caa-4db1-e2c6-08d7bf41224d/financialtransactions"

},

"failedAttempts": {

"id": "/psp/paymentorders/8be318c1-1caa-4db1-e2c6-08d7bf41224d/failedattempts"

},

"metadata": {

"id": "/psp/paymentorders/8be318c1-1caa-4db1-e2c6-08d7bf41224d/metadata"

}

},

"operations": [

{

"method": "GET",

"href": "https://ecom.externalintegration.payex.com/payment/core/js/px.payment.client.js?token=5a17c24e-d459-4567-bbad-aa0f17a76119&culture=nb-NO&_tc_tid=30f2168171e142d38bcd4af2c3721959",

"rel": "view-checkout",

"contentType": "application/javascript"

},

{

"href": "https://api.payex.com/psp/paymentorders/222a50ca-b268-4b32-16fa-08d6d3b73224",

"rel":"update-order",

"method":"PATCH",

"contentType":"application/json"

},

{

"href": "https://api.payex.com/psp/paymentorders/222a50ca-b268-4b32-16fa-08d6d3b73224",

"rel": "abort",

"method": "PATCH",

"contentType": "application/json"

}

]

}

paymentOrder

object

id

string

The relative URL and unique identifier of the paymentorder resource . Please read about URL Usage to understand how this and other URLs should be used in your solution.

created

date(string)

updated

date(string)

operation

string

Determines the initial operation, defining the type of payment order created. Possible options are Purchase, Abort Verify, UnscheduledPurchase, Recur and Payout.

status

string

Initialized is returned when the payment is created and still ongoing. The request example above has this status. Paid is returned when the payer has completed the payment successfully. See the Paid response. Failed is returned when a payment has failed. You will find an error message in the Failed response. Cancelled is returned when an authorized amount has been fully cancelled. See the Cancelled response. It will contain fields from both the cancelled description and paid section. Aborted is returned when the merchant has aborted the payment, or if the payer cancelled the payment in the redirect integration (on the redirect page). See the Aborted response.

currency

enum(string)

DKK, EUR, NOK or SEK). Some payment methods are only available with selected currencies.

amount

integer

The transaction amount (including VAT, if any) entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK.

vatAmount

integer

The payment’s VAT (Value Added Tax) amount, entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK. The vatAmount entered will not affect the amount shown on the payment page, which only shows the total amount. This field is used to specify how much of the total amount the VAT will be. Set to 0 (zero) if there is no VAT amount charged.

description

string(40)

A textual description of the purchase. Maximum length is 40 characters.

initiatingSystemUserAgent

string

The user agent of the HTTP client making the request, reflecting the value sent in the User-Agent header with the initial POST request which created the Payment.

language

enum(string)

Allowed locale code values: da-DK, de-DE, et-EE, en-US, es-ES, fi-FI, fr-FR, lt-LT, lv-LV, nb-NO, pl-PL, ru-RU, or sv-SE.

availableInstruments

array

implementation

string

Enterprise or PaymentsOnly. We ask that you don't build logic around this field's response. It is mainly for information purposes, as the implementation types might be subject to name changes. If this should happen, updated information will be available in this table.

integration

string

HostedView (Seamless View) or Redirect. This field will not be populated until the payer has opened the payment UI, and the client script has identified if Swedbank Pay or another URI is hosting the container with the payment iframe. We ask that you don't build logic around this field's response. It is mainly for information purposes. as the integration types might be subject to name changes, If this should happen, updated information will be available in this table.

instrumentMode

bool

true or false. Indicates if the payment is initialized with only one payment method available.

guestMode

bool

true or false. Indicates if the payer chose to pay as a guest or not. When using the Enterprise implementation, this is triggered by not including a payerReference or nationalIdentifier in the original payment order request.

payer

object

payer resource where information about the payer can be retrieved.

orderItems

object

orderItems resource where information about the order items can be retrieved.

history

object

history resource where information about the payment's history can be retrieved.

failed

object

failed resource where information about the failed transactions can be retrieved.

aborted

object

aborted resource where information about the aborted transactions can be retrieved.

paid

object

paid resource where information about the paid transactions can be retrieved.

cancelled

object

cancelled resource where information about the cancelled transactions can be retrieved.

financialTransactions

object

financialTransactions resource where information about the financial transactions can be retrieved.

failedAttempts

object

failedAttempts resource where information about the failed attempts can be retrieved.

metadata

object

metadata resource where information about the metadata can be retrieved.

operations

array

The array of operations that are possible to perform on the payment order in its current state.

As this is an initialized payment, the available operations areabort, update-order and redirect-checkout or view-checkout, depending on the integration. See Operations for details.Step 2: Display Payment Menu

Among the operations in the POST paymentOrders response, you will find the

view-checkout. This is the one you need to display the purchase module.

Response

1

2

3

4

5

6

7

8

9

10

11

{

"paymentOrder": {

"operations": [

{

"method": "GET",

"href": "https://ecom.externalintegration.payex.com/payment/core/js/px.payment.client.js?token=dd728a47e3ec7be442c98eafcfd9b0207377ce04c793407eb36d07faa69a32df&culture=sv-SE&_tc_tid=30f2168171e142d38bcd4af2c3721959",

"rel": "view-checkout",

"contentType": "application/javascript"

},

]

}

Loading The Seamless View

Embed the href in a <script> element. That script will then load the

Seamless View.

To load the Checkout from the JavaScript URL obtained in the backend API

response, it needs to be set as a script element’s src attribute. You can

cause a page reload and do this with static HTML, or you can avoid the page

refresh by invoking the POST to create the payment order through Ajax, and then

create the script element with JavaScript. The HTML code will be unchanged in

this example.

JavaScript

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

var request = new XMLHttpRequest();

request.addEventListener('load', function () {

response = JSON.parse(this.responseText);

var script = document.createElement('script');

var operation = response.operations.find(function (o) {

return o.rel === 'view-checkout';

});

script.setAttribute('src', operation.href);

script.onload = function () {

// When the 'view-checkout' script is loaded, we can initialize the

// Payment Menu inside 'checkout-container'.

payex.hostedView.checkout({

container: {

checkout: "checkout-container"

},

culture: 'nb-No',

}).open();

};

// Append the Checkout script to the <head>

var head = document.getElementsByTagName('head')[0];

head.appendChild(script);

});

// Like before, you should replace the address here with

// your own endpoint.

request.open('GET', '<Your-Backend-Endpoint-Here>', true);

request.setRequestHeader('Content-Type', 'application/json; charset=utf-8');

request.send();

HTML

1

2

3

4

5

6

7

8

9

10

11

<!DOCTYPE html>

<html>

<head>

<title>Swedbank Pay Checkout is Awesome!</title>

</head>

<body>

<div id="checkout-container"></div>

<!-- Here you can specify your own javascript file -->

<script src="<Your-JavaScript-File-Here>"></script>

</body>

</html>

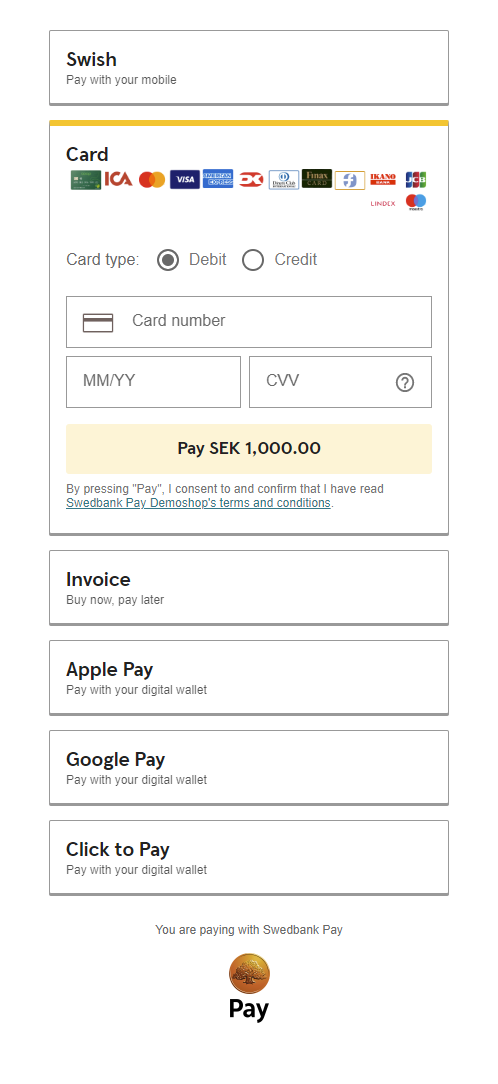

How It Looks

The payment menu should appear with the payer information displayed above the menu. The payer can select their preferred payment method and pay.

Once the payer has completed the purchase, you can perform a GET towards the

paymentOrders resource to see the purchase state.

Events

When integrating Seamless View, we strongly recommend that you implement the

onPaid event, which will give you the best setup. Even with this implemented,

you need to check the payment status towards our APIs, as the payer can make

changes in the browser at any time.

You can read more about the different Seamless View Events available in the feature section.

You are now ready to capture the funds. Follow the link below to read more about capture and the other options you have after the purchase.